3-D Secure: A critical review of 3-D Secure and its

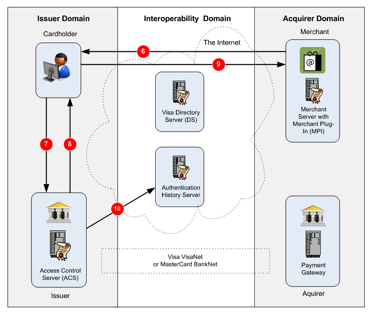

effectiveness in preventing card not present fraud

by

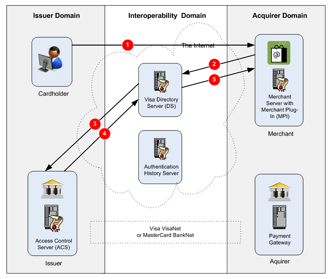

Anthony

Bouch

March 2011

Supervisor: Dr.

Konstantinos Markantonakis

Submitted as part of the requirements for the

award of the MSc in Information Security of the University of London.

In loving memory of

Michael George Bouch

E-commerce

represents a web-based Internet economy that has risen from zero, to over a

trillion dollars worldwide, in just seventeen years.

However,

the security challenges faced by the world’s largest open (and effectively

anonymous) network, have meant that the growth of the Internet – and e-commerce

– has been met with an equally rapid growth in the activities of those intent on

using the Internet as a vehicle for malicious and criminal activities online.

It is

within the context of the growth of the Internet, and in particular e-commerce,

that this report will examine current efforts to reduce the level of fraud in

payment card-based e-commerce.

One of the

core observations made early in this report, is that payment cards are being

used in a way never intended, and that their unsuitability as an instrument of

payment in e-commerce has led to several unintended consequences – including the

dramatic rise of fraudulent payment card transactions online. The fraudulent

use of payment cards in e-commerce also resulted in the need to create a scheme-based

protection measure known as a ‘chargeback’. Chargebacks allow a cardholder to

shop online without the fear of suffering a financial loss from fraudulent

transactions; however, they have also unfairly shifted the liability of

accepting such transactions to the merchant. Merchants have been further

encumbered with an industry attempt at protecting payment card data in the form

of the PCI Security Standards Council Data Security Standard (PCI-DSS).

Additional

findings include the observation that despite well documented weaknesses and

costs associated with the use of payment cards via a web browser and SSL, there

has been a lack of progress by the payment-card industry in providing suitable

alternatives. Noteworthy in this report’s findings is that it has taken close

to a decade, from the payment industry’s first comprehensive attempt at

securing e-commerce (via SET), to implement a scheme designed to reduce payment-card

fraud online. That scheme is 3-D Secure.

Furthermore,

this report concludes, that, despite the time taken to implement 3-D Secure, the

scheme suffers from failings in ownership, communication, usability and

security – while simultaneously burdening Internet users (and cardholders) with

yet another password-based system.

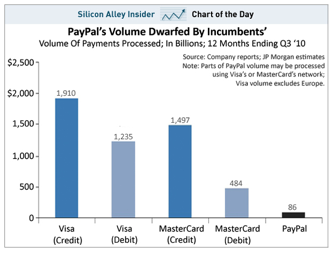

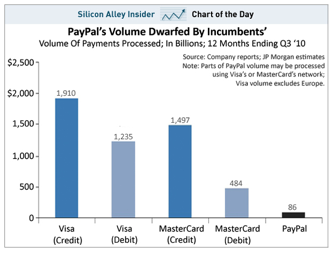

Suggested explanations for the lack of significant

improvements in payment card-based e-commerce (as well as the failure of

alternative schemes to gain significant market-share), include the market

dominance of the two major payment card brands – Visa and MasterCard. The lack of liability for the

use of their own payment instruments, and possibly conflicting obligations

between scheme members and shareholders may have also contributed to a lack of

progress in the development of improved and more suitable payment systems.

This report

also concludes that e-commerce as a whole is likely to see dramatic changes

over the coming years as the potential for integrating smart cards and tokens

with mobile devices is fully realised. What remains to be seen, however, is

whether any scheme that achieves broad commercial success does so because of

its merits in facilitating a safe and convenient e-commerce experience – or because of the

influence and leverage of other ‘vested interests’.

1.1 The Insecure Internet

There are

now an estimated two billion Internet users globally

[1] with over 30

million adult users accessing the Internet everyday in the UK alone

[2] .

From its

origins as an experiment in reliable ‘packet based’ networking in the late

1960s and 1970s

[3] – the Internet has grown into a pervasive interconnected network of computers

and applications that spans the globe and is dramatically changing the world we

live in

[4] .

The early

inventors of the Internet did not anticipate its current size or impact, and while

its growth might serve as a testament to the eloquence of its original design –

from a security perspective, things are a little more complicated.

Early users

of the Internet accessed the network from the relatively safe environment of

academic institutions and protected data centres. Issues of identity and

authentication were considered lightly at a time when the Internet existed

within a culture of co-operation, trust and resource sharing. The result was

that the foundation protocols of the Internet were vulnerable to those who saw

the Internet as a convenient vehicle for malicious and criminal activities

[5,6] .

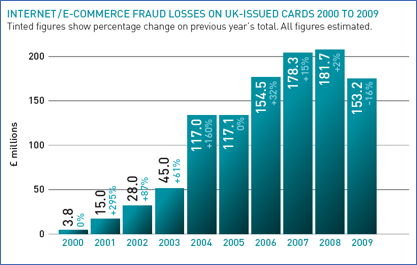

From a

purely commercial perspective, The Internet Crime Complaints Centre (IC3) in

the USA in its 2009 IC3 Annual Report stated a dollar loss in referred complaints

of 559.7 million US dollars

[5] – up from just 17.8 million in 2001. The UK Cards Association reported 266.4 million

pounds sterling in card-not-present fraud in 2009 – from 95.7 million in 2001

[7] .

The growth

of the Internet has provided us with many novel and convenient methods of

communication. And yet it would appear that as more ‘value’ moves into

electronic form and onto the Internet, so too does the risk that information of

value will be lost or used in ways to commit malicious and criminal acts.

It is at

the confluence of these dramatic changes that we find ourselves today – with

increasing value in personal, private and commercial information online, as

well as increasing activity from those intent on making money from criminal

activities via the Internet

[8] . It is also

at the confluence of these changes that most Internet users finds themselves

confronted by a bewildering landscape of terminology and technology. Users are

expected to choose (and remember) numerous account names and passwords. Users

are also expected to defend themselves from solicitous and often fraudulent

emails as well as somehow determine whether the website to which they are about

to hand over their credentials or payment details, is trustworthy and

legitimate, as opposed to a cleverly disguised ruse designed to part them from

their hard-earned cash.

Users as

individuals are not alone in their efforts to defend themselves online, as

security has become a major concern for the commercial and public sectors as

well. However, it’s at this point that the interests of larger organisations

with deep technical knowledge and dedicated resources may not entirely align

with the interests of the average Internet user. The average user is as

potentially vulnerable to changes in the ‘terms’ within which they are expected

to interact and exchange information online as they are to the overt actions of

a malicious third-party.

It also seems

unrealistic to expect users of the Internet to be able to make informed

decisions about the security of their activities online – when most don’t

actually know what the Internet is. Take for example a light-hearted

2009 on-the-spot survey performed by Google employees (see http://www.youtube.com/watch?v=o4MwTvtyrUQ), where about fifty people were

asked what a browser is. Of those asked, only about 8% were able to describe what

a browser is and how it is used on the Internet.

1.2 The Birth of E-commerce

In 1989,

Tim Berners-Lee wrote a note to the European Organization for Nuclear Research

(CERN) management describing a global hypertext system

[9] – which would eventually lead to the invention of the hyper text transfer

protocol (HTTP), hyper text mark-up language (HTML), the ‘browser’,

[10] and what

would ultimately become the millions of web sites hosting web pages that we

visit and view everyday via the Internet – collectively referred to as ‘The

World Wide Web’ or ‘The Web’.

Public

awareness of the Internet and the World Wide Web began to rise in the early

1990s and it wasn’t long before retailers began to see the opportunity to

‘sell’ on ‘The Web’.

Presenting

a catalogue of goods via a web page was one thing – allowing customers to pay

securely was another. In 1994, Netscape released the ‘Navigator’ browser and,

later in the same year, released the first version of the Secure Sockets Layer

protocol (SSL)

[11] – a protocol designed to establish an authenticated and confidential channel

between a browser and a web server. A user using the Navigator browser was

given a visual indication that they were now communicating securely with a web

server via the padlock icon. The image of the padlock ‘unlocked’ would

represent an insecure connection – while the image of the padlock ‘locked’

would represent a secure connection via SSL.

With an

apparent solution to the problem of being able to securely transmit data from

the user’s browser to the receiving Web server, e-commerce sites quickly began

to accept credit cards as a method of online payment for goods and service

advertised on the Web.

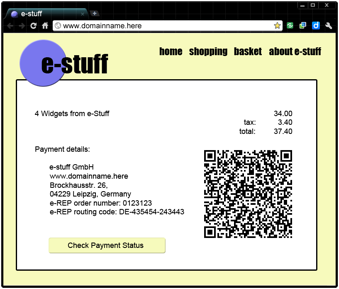

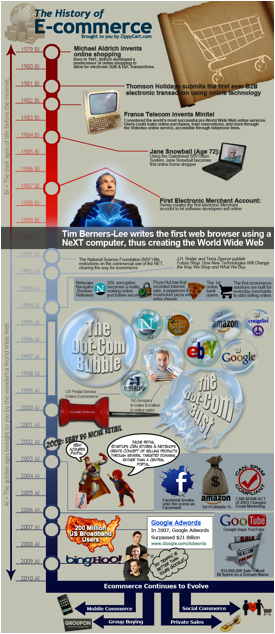

The result

was the creation of the e-commerce industry, including the birth of e-commerce giants

such as eBay and Amazon, and a web-based Internet economy that has risen from

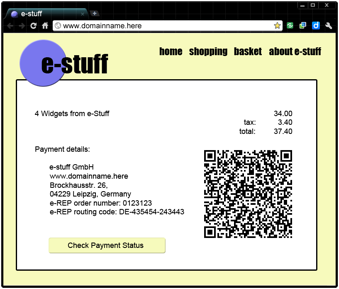

zero to over a trillion dollars worldwide (See Appendix A – The History of E-commerce).

In the UK alone, e-commerce is now estimated at a yearly value of 100 billion

pounds, or 7.2% of GDP

[12] .

The

challenges of keeping payment systems secure have risen proportionately –

particularly in the case of payments made via payment cards over SSL and

despite advances in security mechanisms in general.

These

challenges include:

1. The expectation that the average

Internet user is able to make informed security decisions about their personal

and commercial actives online.

2. The overreliance of usernames and

passwords as a primary method of authentication on the Internet.

3. The need for effective user-friendly

payment methods that also represent good security practises.

1.3 Objectives

It is

within the context of the need to create improved and user-friendly mechanisms

for secure payment systems, as well as to ensure that all parties are fairly

protected and represented, that this report will examine a recent initiative

designed to reduce the level of Internet-based card payment fraud: a system

called 3-D Secure.

The

objectives of this paper, therefore, are as follows:

1. To present a background to payment

models and the payment card industry including the developments that led to 3-D

Secure.

2. To present a technical description

of 3-D Secure, as well as a detailed description of the actors involved in a 3-D

secure transaction.

3. To examine the motivational factors

for adopting 3D Secure, as well as its reception, from the point of view of

each of the main actors – including cost, usability, security, and liability

issues.

4. To compare 3-D Secure with other non-payment

card based options.

5. To summarise 3-D Secure and its

effectiveness in preventing ‘card not present’ fraud.

6. To determine whether 3-D Secure

represents good security practises, as well as fairly represents the interests

of all involved parties.

7. To draw conclusions as to whether

given the current ‘state of affairs’ of e-commerce and online payments systems,

3-D Secure was the right thing to do given all of the above, or whether

alternative solutions would have been more appropriate.

In this

chapter we have presented a brief history of the Internet as well has having

hinted at some of the security challenges that have arisen as a result of its origins

and rapid growth. We have also presented a brief history of e-commerce,

demonstrating that the equally rapid growth in trade on the Internet is forcing

the e-commerce industry to address its own security challenges.

Chapter 2

will provide a background to the current ‘state of e-commerce,’ commencing with

a brief history of payment models and payment cards. Next, we will look at the

security of ‘card present’ transactions and the EMV standard – its advantages

and disadvantages – and then, the security of ‘card not present’ transactions.

From there, we will examine e-commerce via a web browser and SSL/TLS – its

advantages and disadvantages, as well as an e-commerce requirements checklist.

We will finish the chapter by reviewing the Secure Electronic Transaction (SET)

standard – an early attempt at securing e-commerce.

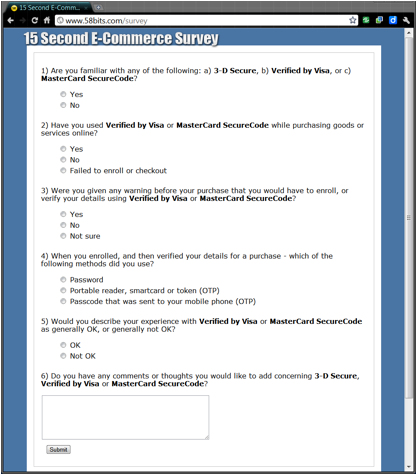

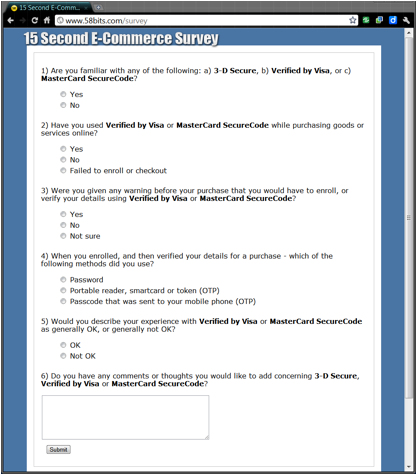

In chapter

3, we will examine 3-D Secure, discussing the advantages and disadvantages,

starting from the merchant’s perspective, and continuing with the perspectives

of the acquirer, the issuer, and the cardholder. An informal user survey is

also presented in this chapter – designed to gauge public opinion and response

towards 3-D Secure.

In chapter

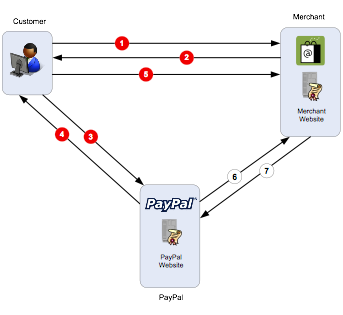

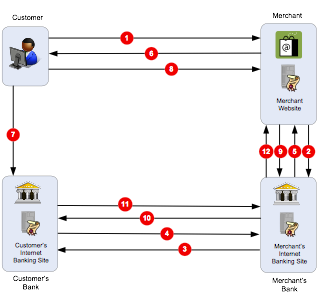

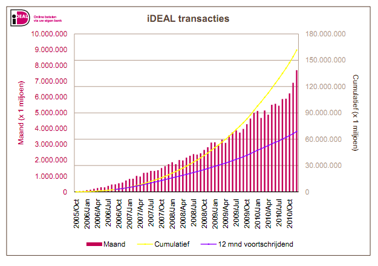

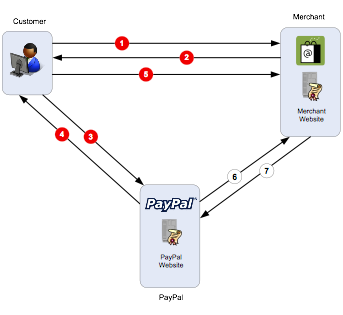

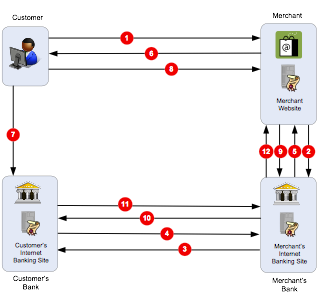

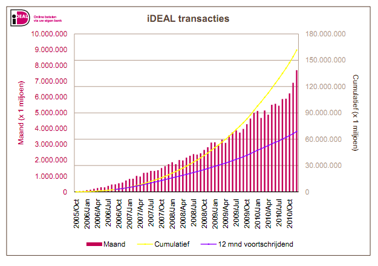

4 we will examine two non-card-based solutions – PayPal and iDEAL. PayPal was

chosen as an example of a ‘three-party’ system, and as such illustrates the

advantages and disadvantages of such schemes. iDEAL was chose as an example of

an alternative ‘four-party’ system that interestingly (like payment cards

themselves), was started by an association of banks in the Netherlands.

In chapter

5 we will briefly examine the future of the e-commerce industry, before moving

on to chapter 6 where we will draw our conclusions as to the appropriateness of

the 3-D Secure system to meet the needs of the e-commerce industry today.

2.1 Payment Models

Few of us

stop to consider why it is that we ‘trust’ the coins and notes we have in our

wallets or purses. We’ve become culturally accustomed to the notion that they

represent monetary value and that they can be used to buy goods and services.

Money serves as a medium of exchange

[13] and our trust in this medium is based entirely on the promise by the issuer

that our coins and notes will be honoured, and so relied upon by the parties

wishing to exchange them for goods and services. Money is an instrument of

payment, and a payment is the process by which money is transferred to a

creditor by a debtor for the extinguishment of a debt

[13] .

Coins and

cash notes are physical tokens that can be used as currency; however, other

tokenized forms of money exist – including electronic money.

The EU

Directive 2009/110/EC of the European Parliament and of the Council defines

electronic money as,

[14]

“…‘electronic money’ means electronically, including magnetically,

stored monetary value as represented by a claim on the issuer which is issued

on receipt of funds for the purpose of making payment transactions as defined

in point 5 of Article 4 of Directive 2007/64/EC, and which is accepted by a

natural or legal person other than the electronic money issuer…”

If a

payment is the exchange of money to extinguish a debt, then an electronic

payment could be described as the transfer of monetary value from one party to

another via an electronic network or device

[15] .

Electronic

payments systems can be divided broadly into two major categories:

1. Cash-like systems that transfer

money using electronic tokens that represent value with no intermediary

instruments, instructions or services – such as a pre-paid e-wallet or

electronic purse.

2. Account-based systems that are used

to transfer a numerical value that represents money, from one account to

another.

Account-based

instruments such as cheques, money orders and credit cards are not money – but

instead provide evidence of the intention and ability to pay via an account-based

system

[13] .

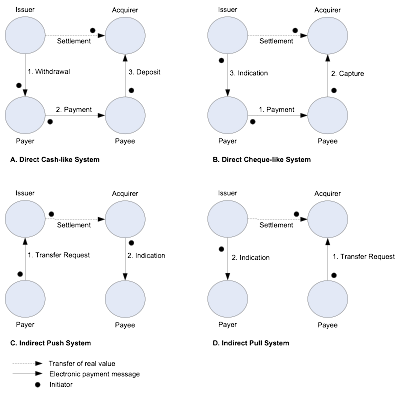

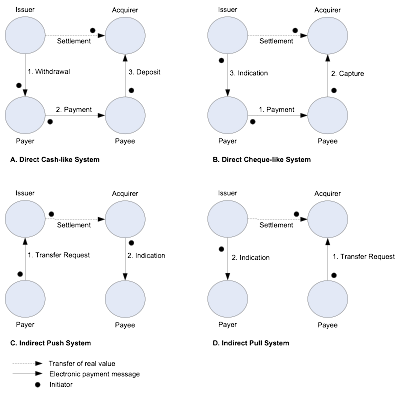

The use of

direct cash-like systems, direct account-based cheque-like or credit card-like

systems, as well as indirect push and pull account systems is summarised by

Peiro et al’s payment model in Figure

1:

[16]

Figure 1 – Direct and indirect payment

models

[16]

Indirect

push or pull systems only involve a single initiator: either the payer, who

initiates a credit transfer (as in the instructions given to a bank to transfer

funds to another account); or a payee, who initiates a debit transfer (as in a

direct debit or standing order).

Other

systems of payment classification have attempted to define payments based on

the immediacy of the transaction (payment on delivery, payment after delivery,

payment before delivery, etc.), the direction of the transaction, as well as

the instruments or instructions of the transaction. One such attempt is a

report by the European Central Bank (ECB) called ‘Classifying Payment

Instruments – A Matryoshka Approach’

[17] .

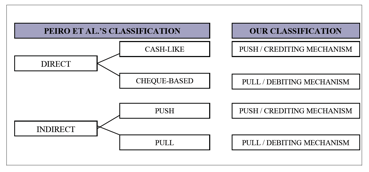

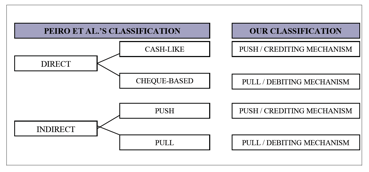

In this report, Peiro et al’s model

above is mapped, with a diminished distinction between direct and indirect

payment systems, as follows in Figure 2:

Figure 2 – A comparison of Peiro et al’s and The Matryoshka taxonomy

[17]

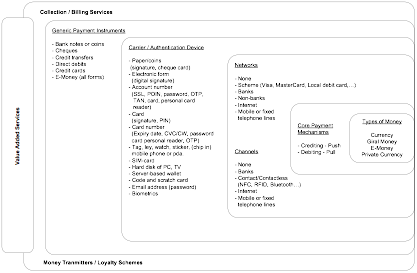

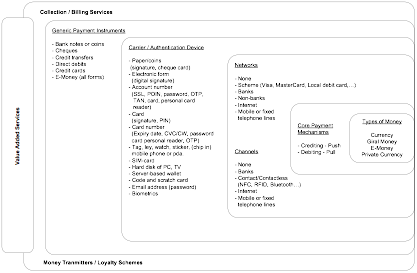

The Matryoshka

model is an attempt to classify mechanisms, instruments or devices as belonging

to one of five layers – one from each of which will combine to form a complete

payment system, as shown in Figure 3 below:

Figure 3 – The Matryoshka model

[17] as adapted and presented in Innopay’s ‘Online Payments 2010’ report

[18]

Innopay

presented an adaptation of the Matryoshka model in its ‘Online Payments 2010’

report

[18] ,

describing the desire to produce such a visual aid in the classification of

payments systems as coming from,

“..the sheer number and diversity of approaches in payment systems

which can sometimes make it difficult to establish a clear understanding of how

a particular scheme works.”

The Innopay

report also highlights several weaknesses in such an approach. However, both

the ECB and Innopay reports make it clear that the world of electronic payment

systems has been, and will continue to be, a dynamic one. A report from the Institut für Informatik der Technischen

Universität München, ‘Chablis Market Analysis of Digital Payment Systems’

in 1999

[15] ,

documents fifty-one separate digital payment schemes including eCash

[19] ,

Mondex

[20] ,

and MilliCent

[21] .

However the majority of these schemes failed to reach wide-scale commercial

implementations.

The rise of

payment cards (credit and later debit cards), combined with SSL in e-commerce,

may have also had an impact on the success of alternative electronic payment

schemes. Once established, the direct account-based method of using a credit

card to authorize the payment of goods and services became a culturally

accepted and well understood mechanism for making payments in the real world.

The ‘shopping cart’ and ‘check-out’ metaphors of web sites in the online world

meant that an already established and easy to understand system for making

payments was successfully applied to e-commerce. Supported by protections for

the cardholder against fraudulent use, payment cards using a browser and SSL

became the predominant method of payment for web-based e-commerce.

2.2 Payment Cards

The

earliest form of payment cards came from oil companies and department stores

which issued their own proprietary cards as a means of creating customer

loyalty. The customer had an ‘account’ with the company and the company sent a

monthly statement and invoice to the customer for payment. Some companies

offered revolving credit, while others required the balance to be paid in full

each month

[22] .

The first

credit card, named ‘Charge-it”, was introduced in 1946 by a banker name John Biggins in Brooklyn, New York. However, the

card could only be used locally – and both the customer and the merchant needed

to have an account at Biggens’ bank

[22] .

The first wide-spread

credit card was the Diners Club Card with 20,000 cardholders in 1951. Diners

Club Cards are ‘charge-cards,’ meaning the bill must be paid in full at the end

of each month. The Diners Club Card was originally made of cardboard (so too

was the Charge–it card); not until a decade later was a plastic Diners Club

Card issued

[22] .

American Express was the first to come out with a plastic charge-card in 1958

[22] .

Bank of

America is credited with the first large-scale credit card programme. In 1958,

60,000 unsolicited BankAmericard credit cards were mailed to customers in

Fresno, California, in what became the first successful credit card ‘drop’

(mass mailing of unsolicited and working credit cards). Confirmed rumours of a

competitor’s pending ‘drop’ led Bank of America to accelerate its programme of

mass mailings. By October of 1959, the entire state of California had seen over

two million credit cards sent to individual addresses. The programme, however,

was a financial disaster. 22% of accounts became delinquent (as opposed to the

estimated 4%) and the state of California was confronted with the brand new

crime of credit card fraud. What’s more, with customers liable for all charges

including those resulting from fraud, the scheme became the focus of intense

political and media pressure. In a “massive effort,” Bank of America was forced

to repair the damage – issuing an open letter of apology to 3 million

households, as well as implementing proper financial controls and fraud

protection measures

[23] .

In response

to Bank of America’s BankAmericard, several other California banks formed their

own association and issued the MasterCharge credit card

[23] .

By the mid-to-late-1970s,

both schemes had grown nationally and internationally into licensed

associations of card issuers and acquiring banks. In 1975, the international

and national networks of BankAmericard were brought together under the new name

of “Visa”, while in 1979 the MasterCharge networks became “MasterCard”

[24] .

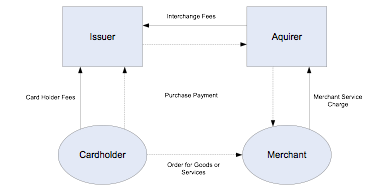

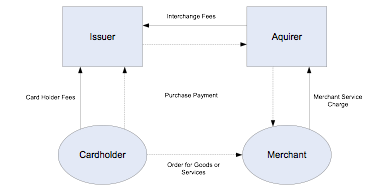

Visa and MasterCard

operate under what is called a four-party system

[25] . The four

entities are:

1. The Cardholder: The individual in possession of a

payment card.

2. The Issuer: The bank or organisation that

issues the card to the cardholder.

3. The Acquirer: The bank which receives payment from

the issuer on behalf of the merchant.

4. The Merchant:

The entity with goods or services to sell that receives payment instructions

and details from the cardholder – to be settled by their acquirer (via the

scheme network) with the issuer.

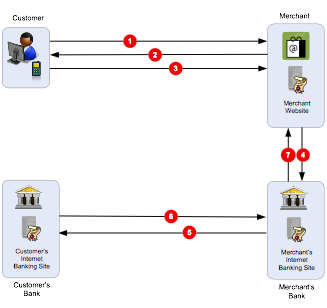

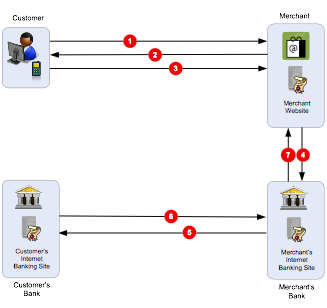

Figure 4 illustrates

the four-party model, including the transaction flow and related charges.

Merchants typically bear the cost of both a payment processing fee by the

acquiring bank as well as an interchange fee. The interchange fee is designed

to recover the costs of operating the scheme network, as well as correct the

imbalance in costs incurred between the issuer and acquirer

[25] .

While the acquirer will typically have payment devices at point of sale – a

terminal or card reader, capable of accepting payments from many cardholders –

the issuer will bear the greater cost of issuing and managing payment cards and

transactions for every cardholder.

Figure 4 – The four-party model

Interchange

fees range from 1-3% of the transaction value

[26] , with

fixed caps in place for certain transactions. However, for online payment

processing payment processors may charge as much as 6% of the transaction value.

The four-party

model allows for scalable ‘trust relationships’ between multiple acquirers and issuers

that are members of a single scheme or network – such as Visa or MasterCard –

while allowing merchants and cardholders to establish their own accounts and

trust relationships with merchant or issuing banks of their choice.

2.3 The Security of ‘Card Present’

Transactions

As Bank of

America discovered after its large-scale ‘drop’ of credit cards in 1959 – it

didn’t take long for fraudsters to realize that payment cards represented a new

money-making opportunity in real word crime. Over the next fifty years, card

issuers and merchants would play a cat-and-mouse game against fraudulent

payment card activity.

‘Card

Present’ (CP) transactions are transactions where the cardholder, card and merchant

are all physically present at the time of payment authorisation using a payment

card.

The two

most significant forms of payment card fraud in CP transactions are the use of

lost or stolen cards (including non-receipt of new cards sent to the

cardholder’s address), and counterfeit cards. Losses from counterfeit, lost and

stolen cards (including non-receipt) accounted for 91% of UK CP fraud in 1999

and 78% of CP fraud in 2009

[27] .

While other

forms of payment card fraud exist (including account takeover and fraudulent

applications

[28] ),

it’s likely that the high percentage of fraud associated with counterfeit,

lost, and stolen cards drove initial payment card protection measures.

Early

measures designed to protect against the use of lost or stolen cards included

comparing the signature on the strip on the back of a card with the signature

of the person attempting to use the card at the point of sale. Policy-based

measures included additional telephone authorisation for large or suspicious

transactions, as well as looking up card numbers on printed lists of stolen or

delinquent cards.

Physical

protection measures against card tampering and counterfeit cards included

embossing, holograms, tamper-evident signature strips, and ultraviolet

printing. The early payment systems also relied on card embossing not only as

evidence of tampering, but also to take an ‘impression’ of the card. Using a

physical card holder, a roller was drawn across the card in order to make a

carbon copy impression on a paper transaction-slip. The customer then signed

the slip for the merchant to later submit for settlement as evidence of the

cardholder’s authorisation.

Figure 5 – Physical Card Protection Measures

(Source:

David Main & Karl Brincat – ‘Information and Security @ Visa - lecture

presented at RHUL, February 2008)

The major

disadvantage of the above measures is that they relied heavily on the merchant

or sales assistant being able to verify the cardholder’s signature as well as

identify suspicious and possibly counterfeit cards

[29] .

The early

1970s saw the introduction of a magnetic stripe on the back of payment cards.

This was after the successful development of magnetic stripe media and

subsequent standards that were agreed upon for both the contents of magnetic

stripe card data, as well as its location on plastic cards

[30,31] . The result

was that a standards-based point of sale (POS) terminal could be used to

‘swipe’ a card to automatically read the card data, as well as automatically

‘dial-up’ for card authorisation.

The data

contained within the magnetic stripe was eventually updated to include a

cryptographic checksum – or card verification value (CVV). The CVV is used to

confirm that the values supplied from the card including the primary account

number (PAN), expiry date, and service code – all match those values that were

used to generate the CVV when the card was first issued. The idea is that while

all of the other card values could be read directly from the card, or obtained

from other sources such as visually inspecting the card, receipts or

correspondence – the CVV was not casually available and could not be recreated

without the key that was used by the issuer to generate the CVV in the first

place.

Despite

physical card protection measures and magnetic stripes, sophisticated and

fraudulent card manufacturing techniques (including card ‘skimming’ techniques

that can be used to copy the entire contents of the magnetic stripe including

CVV value) – meant that until recently, fraud from lost, stolen or counterfeit

cards continued to rise

[7,27] .

2.4 The EMV Standard

In 1994,

Europay, MasterCard and Visa initiated the development of a new system designed

to reduce CP payment card fraud

[32] .

The system is called EMV. It is based on smart card technology and an advanced

end-to-end secure message-level protocol designed to authenticate and authorize

payment card transactions.

In 2002,

Europay merged with MasterCard International to form MasterCard Inc, and the

EMV specification is now owned by American Express, JCB, MasterCard and Visa

[32] .

The EMV

standard in the UK is promoted as ‘Chip and PIN’ – with the ‘chip’ referring to

the electronic chip that is embedded into the plastic payment card, used in

conjunction with the cardholder’s secret personal identification number (PIN).

The chip

that is embedded in the payment card is based on the ISO/IEC 7816 set of standards

for integrated circuit cards with contacts (ICCs)

[33] – generally referred to as smart cards. The ICC in more advanced smart cards is

effectively a small computer – containing a central processing unit (CPU),

random-access memory (RAM), read-only memory (ROM) and electrically erasable

programmable read-only memory (EEPROM). Smart cards are primarily used to add

security to a system since they contain several physical and security-related

features that make them attractive in such a role

[34] .

These

include:

· They are small and thin - which

means they can be mounted on cards or tokens and will fit in a wallet, purse or

other small device.

· They are not easily forged or

copied.

· They are resistant to tampering.

· They can store data securely.

· The can run multiple security

algorithms and functions.

· They are consistent and controlled

(unlike a personal computer).

· They are (for the moment at least)

standards-based.

· The chip-carrying card or token can

be personalized or branded.

· The chip can (if required) be

formally evaluated in order to provide assurances as to the integrity and

reliability of the chip’s security functions. Evaluations can be performed

using the ‘Common Criteria’ to rank and assign an evaluation level to the smart

card that represents the level of assurance of its security properties and

services

[35] .

A card of the appropriate level can be chosen for a given application. Cards

used in financial transactions like EMV are typically evaluated to EAL4 and

above.

Figure 6

illustrates a payment card with and embedded chip (circled in red).

Figure 6 – An ILLUSTrATION of aN ISO 7816

chip placed in a payment card (Source: http://en.wikipedia.org/wiki/File:Smartcard2.png

licensed under Creative Common Share Alike)

The rollout

of EMV required that new chip-containing payment cards be issued to

cardholders, along with new EMV terminals and PIN entry devices issued to

merchants.

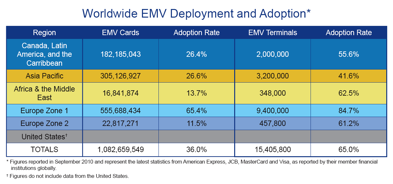

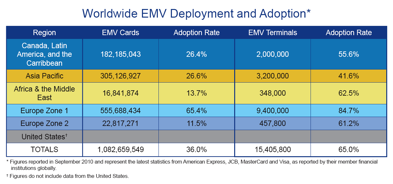

The

worldwide deployment of EMV is shown in Figure 7 below:

Figure 7 – Worldwide EMV Deployment and

adoption (Source: EMVCo www.emvco.com)

EMV isn’t

the first wide-scale application of smart card technology. Similar challenges

were faced by the mobile communications industry in the late 1980s and early

1990s, when the first generation analogue mobile networks saw significant

increases of mobile phone cloning and eavesdropping. The response was the

introduction of the Subscriber Identity Module or ‘SIM Card’ in 2G networks and

mobile handsets creating the largest number of smart cards (or smart tokens,

since the SIM card is not actually a full-sized card) in general use for any

industry to date. What’s more, with over two billion ‘SIM Cards’ deployed, they

can be credited for having pushed the envelope in technical advances and

functionality in smart card technology. And that as a result, they reduced the

overall cost of implementing smart card-based applications – paving the way for

their adoption in finance, identity, transport , physical access control and

other applications

[34] .

What is interesting about the EMV application is that it is the first wide-scale

deployment of smart card technology for use in an electronic payment system.

It’s worth

briefly examining the EMV application in more detail for the following reasons:

1. It contains features that are important

in secure systems and smart card applications, including standards-based

security protocols, formal security evaluations and the use of strong

cryptographic functions to provide certain assurances in payment transactions.

2. It does not completely solve or

remove the risk of payment card fraud in CP transactions.

3. It initially resulted in a shift in

liability or ‘burden of proof’ in cases where fraudulent activity still

occurred.

4. It is actively being promoted as a

platform upon which extra layers of security, including e-banking and ‘card not

present’ e-commerce solutions, can be built.

The EMV

specification has been published as four separate ‘books’ – designed to ensure

interoperability between chip cards and terminals on a global basis

[36] .

Book 1 – Application Independent ICC to

Terminal Interface Requirements

Book 2 – Security and Key Management

Book 3 – Application Specification

Book 4 – cardholder,

Attendant, and Acquirer Interface Requirements

The Normative

References section of Book 1 lists the ISO standards relevant to the EMV

specification. These include ISO 7816, which defines the physical

characteristics of the card, dimensions and location of contacts, interface and

communication protocols, as well as security functions and application specific

commands. ISO 7816 is the standard that allows payment cards (as well as any

other ISO 7816 based cards) and point of sale terminals to interoperate – since

a standard ISO 7816 card with a chip can be inserted into and read by a

standard ISO 7816 card reader and PIN entry device.

Also

included in Book 1 are ISO references to cryptographic mechanisms including

hash functions, message authentication codes (MAC), digital signatures as well

as symmetric and public key cryptography. A detailed explanation of

cryptographic principles and primitives is outside the scope of this paper,

however excellent introductions to cryptography and cryptographic mechanisms

can be found in

[37,38,39] .

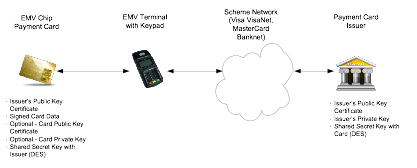

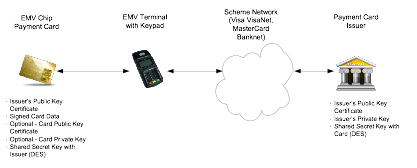

The main

components of the EMV scheme are shown Figure 8.

Figure 8 – The main components in an EMV

application

The

scheme’s security depends on the underlying security properties of the smart

card, allowing the card to safely store secret keys that are required in an EMV

transaction.

The goal of

the scheme is to validate payment card data – ensuring that a valid card is

being used, as well as optionally perform mutual authentication between the

payment card and card issuer.

The scheme

can also verify the cardholder via cardholder verification methods (CVMs). One

method is to request a PIN number from the user – entered into the terminal

keypad. Another familiar and still valid method is to request the cardholder

sign a receipt – as with previous magnetic stripe cards. The decision to use

either may depend on the capabilities of the terminal and the phase of EMV

adoption. Using a PIN number in conjunction with a valid card provides what is

referred to as ‘two factor’ authentication: Something the cardholder ‘has’ – i.e.

the payment card – as well as something the card owner ‘knows’ – i.e. the PIN

number.

The scheme

is flexible in terms of making risk-based decisions about how a transaction

will proceed. Based on policies set by the issuer and acquiring banks, the

terminal and the card can decide on which CVM method to use. Processing a

transaction ‘offline’ means the cardholder is verified without connecting to

the scheme network and card issuer, saving connection and network costs.

Proceeding ‘online’ involves connecting to the scheme network, and performing

card-to-issuer authentication and transaction authorisation. The card can be

programmed to ‘go online’ depending on the number of previous offline transactions

that have occurred, or based on transaction value or other parameters. The

terminal can decide to go online based on: floor limit checking (to protect

against an attempt to split transactions into smaller individual transactions);

velocity checking (lower and upper limit checking of the number of offline

transactions that can be performed before the transaction must go online);

random transaction selection; or where an exception list of cards exists. In

other words, both the card, and the terminal can decide to reject or approve a

transaction ‘offline’ or request that the transaction proceed ‘online’ for

further processing and checks.

The high

level phases of an EMV transaction (as per Book 3) are:

1. Initiate the Application Processing – the terminal informs the chip on

the card that a new transaction is beginning, and exchanges a list of files and

records that contain the chip data that will be used in the processing of the

transaction.

2. Read Application Data – the terminal reads the files and

records described in step 1 above.

3. Perform Card Data Authentication – the terminal authenticates the

card data using one of three possible data authentication schemes: Static Data

Verification (SDA); Dynamic Data Verification (DDA); or Combined Data Verification

(CDA). This step may be performed at any point after phase 2 – Read Application Data but before phase 7 – Terminal Action Analysis.

4. Processing Restrictions – the terminal checks compatible

application version numbers, usage control and expiry dates. This step may be

performed at any point after phase 2 but before phase 7.

5. Cardholder Verification – the terminal assures that the

person presenting the card is the person to whom the card was issued. Assuming

the card can perform cardholder verification, one of the issuer-specified

cardholder verification methods (CVMs) will be executed. This may include

online or offline PIN verification. This step may be performed at any point

after phase 2 but before phase 7.

6. Terminal Risk Management – depending on its capability, the

terminal will perform risk management functions – as described above –

including floor limit checking, random transaction checking, velocity checking.

Terminal risk management may be performed at any time after phase 2 but before issuing the first

GENERATE AC command.

7. Terminal Action Analysis – once application processing in a

normal transaction has reached this stage, the terminal makes the first decision

as to whether the transaction should be approved offline, declined offline, or

proceed online. If the terminal decides to approve the transaction offline, it

will send a ‘GENERATE AC’ (generate application cryptogram) command to the

card, requesting a transaction certificate (TC). Alternatively, if the terminal

rejects the transaction offline, it may send a ‘GENERATE AC’ command to the

card, requesting an application authentication cryptogram (AAC).

8. Card Action Analysis – in response to the ‘GENERATE AC’

command from the terminal, the card performs its own issuer-specific risk

management functions: either approving the transaction offline by returning a

TC, or by requesting to go online by returning an application request

cryptogram (ARQC); or declining the transaction by returning an AAC.

9. Online Processing – if the terminal has received an

ARQC from the card in response to the first ‘GENERATE AC’ command, the terminal

then attempts to go ‘online’ to facilitate card-to-issuer mutual authentication

via application request cryptograms (ARQC) and application response cryptograms

(ARPC). Book 3 of the EMV standard describes this phase as similar to the

processing of magnetic stripe card data, noting, “Actions performed by the

acquirer or issuer systems are outside the scope of this specification”. In practise, cryptograms generated using the

issuer’s stored keys from the card as well as from the issuer, are used to

perform mutual card and issuer authentication. When the terminal receives the

response from the issuer, the response is forwarded to the card – along with an

EXTERNAL AUTHENTICATION command, or a second GENERATE AC command. If card and

issuer authentication has succeeded and the issuer has approved the transaction

(including in the replying ARPC), then the card will reply with either a TC

(approved) or an AAC (declined).

10. Issuer-to-Card Script Processing – if the transaction has gone

‘online’ the issuer may respond with an issuer Script that can be processed by

the card before or after the second ‘GENERATE AC’ command. Issuer scripts can

be used to perform management functions and updates on the card.

11. Completion – the terminal performs this

function as the last function in the transaction – after the card has indicated

it is completing the transaction by issuing a TC, or an AAC in response to the

first or second ‘GENERATE AC’ command.

It’s worth

looking at phase 3 Perform Data Authentication in more detail since it is

this component (along with cardholder Verification) that provides the core

assurances and advantages over magnetic stripe cards.

Performing

Data Authentication assures the terminal that the card in use is genuine and

has not been tampered with or is not counterfeit. Data Authentication relies on

a complete public key infrastructure (PKI) in which the payment card scheme

network (e.g. Visa or MasterCard) acts as the Certificate Authority (CA). The

CA signs and creates certificates for card issuers’ public keys – copies of

which are placed on the payment card for retrieval by EMV terminals. The CA

public key is also distributed and placed on all EMV terminals so that they can

retrieve and verify the issuer’s public keys on the card.

As

mentioned earlier, there are three methods of card data authentication, which

bear further examination here.

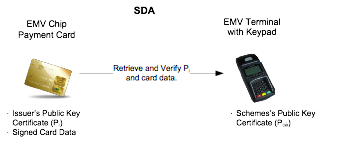

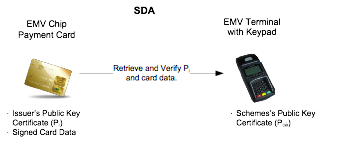

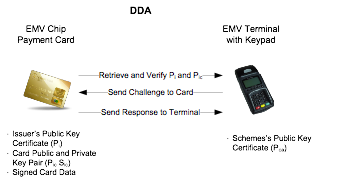

1. Static

Data Authentication or SDA (Figure 9)

Figure 9 – offline Static Data authentication (SDA)

SDA is

performed as follows:

1. The terminal retrieves the card issuer’s

public key certificate (Pi) as well as the card data that has been

signed by the issuer’s private key.

2. The terminal verifies the issuer’s

public key Pi (which has been

signed and certified using the CA/Scheme private key) using the scheme’s public

key Pca (which is placed in all terminals).

3. The terminal then uses the verified

Pi to verify the signed card

data.

If

successful, SDA assures the terminal that the card data has not been modified

since it was issued by the issuer.

The primary

advantage of SDA is that no public key cryptographic processing is required by

the card. Cards without public key cryptographic processors cost less, and so,

issuing SDA cards results in cost savings.

The

disadvantage of SDA is that, for offline transactions, it is theoretically

possible to clone the signed card data, creating a counterfeit card. A PIN

would not be required for a counterfeit SDA card since the card could be

programmed to accept any value for a PIN number

[40] .

2. Dynamic

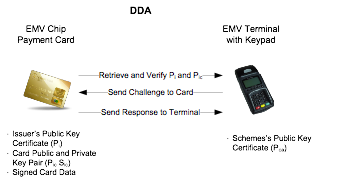

Data Authentication or DDA (Figure 10)

Figure 10 – OFFLINE DYnamic Data

authentication (DDA)

DDA

requires a smart card that is capable of performing public key cryptographic

functions. When the card is manufactured, a card–specific private (Sic)

and certified public (Pic) key pair is placed on the card. The key

pair is used during card data authentication as well as optionally for secure

transmission of the PIN to the card during CVM.

DDA is

performed as follows:

1. The terminal retrieves the issuer’s

public key Pi and the card

public key Pic certificates from the card. The issuer’s public key Pi is verified by the terminal using the

scheme’s public key Pca. The card public key Pic is then

verified using the issuer’s public key Pi .

2. The verified card public key Pic can now be used by the terminal to send a challenge that has been encrypted

with the card public key Pic.

3. The card decrypts the challenge

using the card private key Sic. The card then returns the challenge

as well as the signed card data to the terminal for verification.

The

advantages of DDA include the fact that the card is actively participating in a

cryptographic challenge and response using public key cryptography. It is

therefore able to authenticate the card data, as well as provide assurances

that the data has been returned from an active and valid card. This assurance

is provided by the security features of the smart card – which include secure

key storage and tamper resistance – making it practically infeasible for a

counterfeit card to be produced that contains the private key Sic.

The

disadvantages of DDA include the fact that it requires a card with a public key

cryptographic processor, which in turn increases the cost of the card. It is

also theoretically possible to perform a ‘wedge attack’ on a stolen DDA card.

This is an attack in which valid DDA data is used to pass data authentication,

but where a ‘wedge’ or ‘man in the middle’ device is used to answer ‘yes’ for

any PIN CVM attempt. The ‘wedge’ then simulates remaining card actions in order

to obtain authorisation for payment

[41] .

This is effectively a time-of-check-to-time-of-use (TOCTTOU) exploitation.

3. Combined Dynamic Data Authentication with AC

Generation or CDA

Combined

Dynamic Data Authentication is performed at the first or second GENERATE AC

command from the terminal. In this case, DDA is performed simultaneously with

the response to the GENREATE AC command and so the response (TC, ARQC or AAC)

can be verified at the same point in time as the card data is

verified via DDA.

The

advantage of CDA is that it makes performing the ‘wedge’ attack described above

practically infeasible.

EMV offers

the following advantages over traditional magnetic stripe CP transactions:

1. The use of smart card technology

provides portable security services and secure key storage.

2. Flexible risk management options allow

policy-based settings in the card or terminal to ‘decide’ if the transaction

can be completed offline, or must proceed online – offering cost savings in

offline transactions.

3. Despite the well documented

challenges of implemented x509 certificate-based public key infrastructure

(PKI)

[42] ,

EMV successfully uses public key cryptography and scheme-based PKI to allow EMV

cards and terminals to engage in a dialogue that validates card data and

assures the terminal – and therefore the merchant – that the payment card is

authentic and valid.

4. The use of PIN entry as a cardholder

verification method ‘binds’ the card to the cardholder, providing two-factors

of authentication (something the cardholder possess, and something the cardholder

knows).

5. The use of online processing –

combined with shared symmetric keys between the card and issuer – allows the

card and issuer to mutually authenticate and exchange messages via message

authentication codes (MAC) and cryptograms. This is an extremely important

feature of the scheme, since it provides online message-level end-to-end

security – including data origin authentication and non-repudiation services.

The

disadvantages of EMV are:

1. Implementing the scheme is costly,

and includes issuing new cards and terminals.

2. SDA-only cards are vulnerable to

card cloning and fraud in offline transactions

[40] .

3. PIN codes can be observed via

‘shoulder surfing’ while a cardholder enters their PIN into a terminal.

4. The terminal itself is outside of

the cardholder’s control and so the cardholder could be ‘tricked’ into

inserting their card into a fake EMV terminal. Fake EMV terminals can collect

PIN and card details, which can be used to create either counterfeit magnetic

stripe cards, or counterfeit SDA chip cards for offline authentication

[43] .

5. Although requiring careful co-ordination

and an active attack against the cardholder, EMV cards (including DDA cards)

could also be vulnerable to a ‘relay attack.’ In a relay attack, the cardholder

places their card in a fraudulent terminal. The data and instructions from the

valid card are then relayed to another terminal, where the products, services

and price can be changed before authorising the transaction

[44] .

6. Prior to 2009 in the UK, banks (card

issuers and acquiring banks) operated under a voluntary code of practise known

as The Banking Code. Under this scheme, the technological advances of

EMV shifted the ‘burden of proof’ and ‘reasonable care’ to the cardholder for

any fraudulent activity involving chip and pin cards. The claim made by the

banks in this case was that their system was ‘secure’ and so, therefore, any

fraudulent activity must be the fault of the cardholder for not taking

‘reasonable care’ to ensure that their payment card was safe and being used

correctly. This was seen by some as the banks ‘dumping’ their payment card risk

onto their customers

[40] . On the 1st of November 2009,

responsibility for the regulation of deposit and payment products transferred

to the Financial Services Authority

[45] .

Under the FSA, the onus has returned to the banks to prove negligence or fraud

by the cardholder.

In summary,

the intrinsic security features of smart card technology, combined with a standards-based

implementation, has meant that EMV has increased the security of CP

transactions. This has resulted in a significant reduction of CP transaction

fraud

[27] . That said,

the security of any system represents at best, a balance between usability,

effectiveness, cost, and the acceptance of any unmitigated or residual risks

that remain after the system has been implemented. It remains to be seen how

over the long-term, EMV will perform, and whether documented and more

sophisticated payment card system attacks will force the payment card industry

to further revise and improve the security of the scheme.

More

interestingly, and particularly relevant to the remainder of this paper, the

success of EMV has been attributed to a rise in fraudulent ‘card not present’

transactions

[46] ,

such as the use of credit or debit cards to make payments online via the

Internet. Fraudsters have shifted their attention to what may now be perceived

to be the weakest link in the use of payment cards: payment cards used in e-commerce.

2.5 The Security of ‘Card Not Present’

Transactions

Visa

defines a ‘card not present’ (CNP)

[47] transaction as:

“... a transaction that takes place remotely – over the internet, by

telephone or by post.”

Mail order

(by post) and telephone order transactions are also sometimes referred to as

MOTO transactions.

CNP

transactions are particularly vulnerable to fraud for three significant

reasons:

1. The card data cannot be verified via

a magnetic stripe or EMV chip.

2. The cardholder cannot be verified by

comparing a signature with the signature stripe or by entering a PIN into an

EMV terminal.

3. The cardholder may initially be

unaware that their card details are being used fraudulently in CNP transactions

(unlike the physical theft of a payment card).

CNP

transactions also require a very different trust relationship between the

customer and merchant, since goods cannot be given to the customer at the time

of payment.

In MOTO

transactions, the cardholder can establish a degree of trust via traditional

means, including:

1. Dealing with well known or

recognised brand.

2. Ordering from a well-known

catalogue. A company that is going to make the investment required to print and

distribute a catalogue is perhaps ‘more likely’ to be a legitimate merchant

than not.

3. Verifying the merchant’s telephone

number, address and directory listing.

4. A recommendation from a friend.

5. Previous experience.

There is

still a chance that a merchant could act in bad faith – not delivering goods

and services.

Consumer

protection legislation combined with the rules and regulations of the scheme will

provide the cardholder protection against fraudulent merchant activity as well

as the fraudulent use of their card details

[48] .

Scheme protection in particular will allow a cardholder to dispute a fraudulent

payment transaction in order to receive a refund. If a disputed claim is

successful, it will result in a ‘chargeback’ initiated by the card-issuing bank

against the acquiring bank and merchant. The merchant’s account will be debited

and the funds returned to the cardholder.

‘Chargebacks’

are an important form of consumer protection from unscrupulous merchants,

encouraging merchants to supply the goods and services as advertised. However,

they also represent a significant risk to ‘good’ merchants from payment

transactions that have been deemed fraudulent (for example where payment card

details have been used without the consent of the cardholder).

In an

attempt to reduce the merchant’s risk of fraudulent CNP transactions, payment

card manufacturers added another cardholder verification method: a three-digit

value printed on the back of the payment card, known as CVV2. As mentioned

previously, the first CVV value to be used was a cryptographic checksum stored

in the magnetic stripe of the card in an attempt to validate card data. The

CVV2 value printed on the back of the card is also a cryptographic checksum;

however it is not hidden, and can be requested during a CNP transaction.

CVV2 was an

attempt to add ‘something known’ only by the cardholder to the transaction.

Historically, card details including embossed PAN, expiry date and cardholder

name could be retrieved from receipts, casual observation, or even overheard

during a telephone transaction. The CVV2 value is not part of regular CP

transactions; it is requested in CNP transactions. However, the fact that it is

visible on the reverse side of the card, for anyone who handles the card to

see, means that the CVV2 is also vulnerable to collection, and is a weak form

of cardholder authentication.

The methods

of establishing trust and authorisation in MOTO transactions have mostly been

carried forward onto the Internet via the use of a web browser and SSL. These

methods have included the use of CVV2 values, as well as cardholder protection

in the form of merchant chargebacks. However, there are additional risks when

payments are made online – risks that are unique to the use of an open and

effectively anonymous communication network like the Internet.

On the

Internet, it becomes increasingly difficult to verify the identity and

establish the trustworthiness of communicating parties – whether it is the

‘trustworthiness’ of a web site, or the ‘trustworthiness’ of the payment card

details. (A problem now famously epitomised by Peter Steiner’s cartoon and

caption published in The New Yorker on July 5, 1993 – “On the Internet, nobody knows you’re a dog.”

[49,50] .)

The next section

examines some of these issues and how they relate to e-commerce payments made

using a web browser and SSL.

2.6 E-commerce via a Web Browser and SSL/TLS

As

established in section 1.2 – The Birth of

E-commerce, SSL and its successor Transport Layer Security (TLS)

facilitated growth in e-commerce. However, the difficulty of establishing the

‘trustworthiness’ of communicating parties on the Internet also highlights

several fundamental weaknesses that occur when attempting to transfer a real-world

‘payment instrument’ onto the Web.

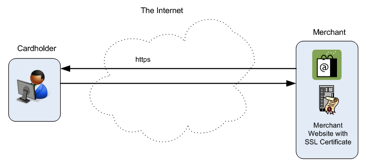

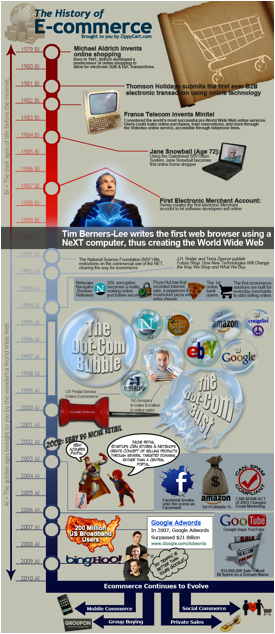

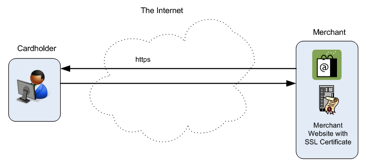

Figure 11

illustrates the ‘straight-line’ communication between a user, using a web

browser, and an e-commerce merchant, using an SSL certificate, to enable a

secure channel between the browser and the merchant’s website.

Figure 11 – E-commerce via a web browser and

ssl/TLS

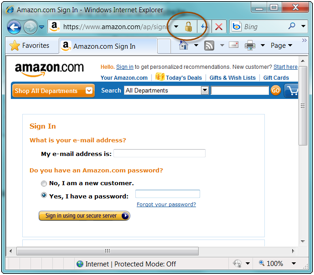

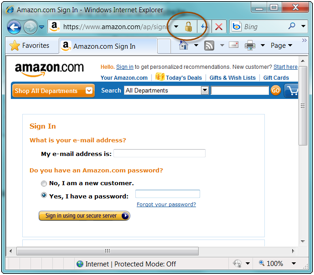

Figure 12 shows

Microsoft’s Internet Explorer browser visiting the ‘Sign In’ page for

Amazon.com. The only indication the user has been given, that they are visiting

a web page that is ‘secure,’ is the small padlock symbol to the right of the

address line in the browser window (circled in red). More astute users may also

notice that there is now an ‘s’ appended to the ‘scheme’ portion of the Uniform

Resource Locator (URL) of the page – https – indicating the use of Hypertext

Transfer Protocol Secure (HTTPS).

Figure 12 – A Web browser visiting a secure

page at AMAZON.COM

In Figure

12, the user is about to enter their email address and password. However, from

the visual cues provided, it’s unlikely that the average internet user is going

to be aware of the current ‘state’ of their connection to the website. Amazon –

perhaps realizing this, and in an effort to establish trust – has included

another visual security cue in the form of a descriptive button which reads:

‘Sign in using our secure server.’

Nevertheless,

the user is expected to ‘trust’ that the site they are visiting is in fact

Amazon.com – again by paying careful attention to the address line in their

browser window. Page artwork, logos, and text on the page certainly give the

impression that user is visiting Amazon.com. But this artwork and text could

have been copied, and the site they are visiting could be http://www.amazo.com, http://www.amazon–deals.com, http://www.amazon–sign–in.com, or even http://www.amazon.ru.

The user

could attempt to verify the SSL certificate that has been issued to the

website.

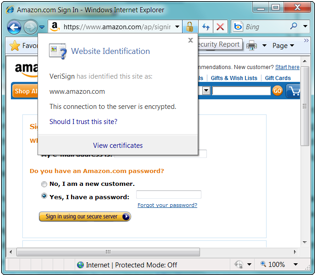

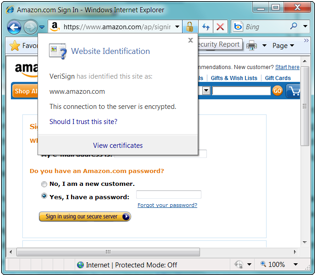

Figure 13

shows an image of the pop–up window that appears in Internet Explorer when a

user ‘clicks’ on the secure padlock icon.

Figure 13 – Viewing certificate information

from AMAZON.COM

Although

there is helpful text available that describes some of the issues associated

with trusting a website, clicking on the View certificates link reveals the

following in Figure 14:

Figure 14 – Certificate information for a

website

It’s

unlikely that the user is going to understand what SSL/TLS, HTTPS, or the

certificate details above actually mean in terms of their connection to the

website in question.

What’s

more, the challenges a user faces in correctly identifying a web site, the

address of a website, and the current state of their browser’s connection to a

web site have been effectively exploited in what are commonly referred to as

‘phishing attacks’. A phishing attack is an attempt by a malicious party to

masquerade as a ‘trusted’ source or website in an attempt to retrieve sensitive

information like usernames, passwords and payment card details. Phishing

attacks are a form of ‘social engineering’ and have been highly effective on

the Internet

[51,52,53,54] – mainly because of the ‘poor usability’ issues described above.

Of course,

it can’t all be bad. The latest versions of the major Web browsers (Internet

Explorer, Firefox, Chrome) have made modest improvements in helping to warn a

user if the site they are visiting is a potential phishing site, or whether

there are problems with the SSL/TLS certificate the website is using. Major e-commerce

sites and banks are also vigilant in monitoring and initiating the removal of

fraudulent or ‘phishing’ websites. Most have also implemented awareness and

user education campaigns in order to help users understand the importance of

the domain name portion of the URL and site certificates. Users are still

vulnerable to phishing attacks – however these efforts, along with a familiar

‘direct account–based’ method of payment card authorisation have meant that the

e-commerce industry has been able to grow to the size that it is today.

The

advantages and disadvantages of e-commerce via a web browser and SSL/TLS can be

summarized as follows:

1. The use of a payment card as a

payment authorisation technique is well known and understood by consumers and

merchants.

2. The SSL/TLS protocol comes free with

most web browsers.

3. The major SSL/TLS certificate

providers have root certificate authority public key certificates pre-installed

with all major web browsers.

4. Apart from a web browser, no

additional software is required by the customer.

5. The shopping cart and check-out

metaphors employed by many e-commerce websites are generally easy for a user to

understand and use to successfully ‘check-out’ and authorize payment.

6. Scheme protection against fraudulent

activity in the form of chargebacks allows cardholders to shop online with

increased confidence.

The

disadvantages of e-commerce via a web browser and SSL/TLS can be summarized as

follows:

1. The user and the merchant both have

significant ‘trust’ challenges. The user is expected to reliably determine that

they are communicating securely with the intended merchant’s website by viewing

the ‘closed padlock’ and other browser indicators including the domain name and

other certificate symbols, information or warnings. In this respect ‘phishing

attacks’ have substantially increased the risk to the user from rogue or ‘faux’

websites

[51] .

2. Even if a user is savvy enough to

determine that the SSL certificate and domain name of an e-commerce site is in

order, the merchant has no equivalent method of verifying the user. Mutual

authentication via SSL is almost never performed. It is therefore difficult for

the merchant to determine that the payment card details they had received were

supplied by the cardholder, and not someone impersonating the cardholder for

fraudulent purposes.

3. Securing the connection between the

browser and a website via SSL/TLS says nothing about how sensitive information

like credit card and payment details might be handled after they

have been delivered to the receiving end of an SSL connection. SSL/TLS is not

an end-to-end payment transaction protocol. It is a means to secure the

communication between two points only. The payment cards details (include all

of the details required to initiate a transaction elsewhere, including PAN,

cardholder name, expiry date, address and CVV2 values) are transmitted without

anything equivalent to an electronic signature or other cryptographic

protection. What’s more, the same details are being used over and over again at

many difference sites, increasing the risk of this information falling into the

hands of fraudsters with each use. (As an aside, if the PAN and related data

were considered the ‘keys’ to the transaction then from a ‘cryptographic’ point

of view their use in this way would be considered a particularly bad key

management strategy.)

4. Since the user’s details including

full name and address almost always accompany the payment card details, the

user has no way of performing an anonymous transaction (unlike the use of

cash).

5. There is limited protection to the

merchant from chargebacks, whether from fraudulent use of payment card details,

or repudiation by the client in the case of a ‘false’ claim.

As we can

see, the security of CNP transactions via a web browser and SSL/TLS are lacking

in many respects. They are without even the (now relatively weak) protections

afforded by magnetic stripe transactions, and with none of the protections

afforded by EMV.

As a

result, several additional verification and policy-based protection measures

have been used to help reduce levels of fraud in payment card based e-commerce,

including:

1. Where available, an address

verification service (AVS) can check that the numerical address, entered by the

user as their ‘billing address’ during check-out, matches the numerical portion

of the registered cardholder’s address .

2. Payment processing companies (acting

on behalf of merchants) may also perform additional checks – including

attempting to verify that the customer is using a computer and web browser with

an IP address that originates from the same country as the cardholder’s

address.

3. Merchants may also implement their

own policy-based controls – such as allowing a customer to request purchased

goods be delivered to an address other than the cardholder registered address

only after they have made one or more ‘good’ purchases from the

site.

Despite

these attempts at protecting CNP transactions, payment card fraud in e-commerce

continues to rise. The HSBC UK website has the following to say about

fraudulent activity in CNP transactions

[46] :

“Card not present (CNP) fraud is perpetrated by telephone, mail

order, fax or the internet and has seen a dramatic increase from £29.3m in 1999

to £290.5m in 2007. It is now the most prevalent category of fraud in the UK.

This figure is expected to continue to rise as fraud becomes more

difficult to undertake in the face-to-face environment as a result of

initiatives like chip and PIN.”

The success

of EMV itself combined with the above noted weaknesses in relying on web- based

e-commerce via SSL/TLS highlights the use of payment cards online as an

attractive target for fraudulent activity.

In fact, it

could be argued that the use of payment cards in a way never intended (like the

Internet itself) is in part responsible for another entire industry of payment

card related processing, security, security consulting and compliance related

activities. The most significant of these developments is the PCI Security

Standards Council Data Security Standard (PCI-DSS)

[55] .

The standard was created by Visa and MasterCard and includes a set of over 200

auditable controls designed to protect payment card data. Levels of compliance

with the standard are set depending on the levels of transactions being

processed. High-profile security breaches such as the loss of 40 million credit

cards by CardSystems solutions in 2005

[56] are an

indication of the size of the problem, as well clearly defining the motivation

behind the creation of such a standard. However compliance with the standard

introduces additional costs to the merchant, in the form of upgrading systems,

verifying compliance (internal or external audits) and maintaining compliance

[57] .

2.7 An E-commerce Requirements Checklist

The current

technological convergence of the Internet, e-commerce, smart card technology

and, in particular, mobile technology, suggest that opportunities exist to

improve the security of e-commerce using payment cards. Opportunities may also

exist to introduce alternative schemes, possibly even ‘re-introducing’ some of

the advantages that exist in cash and cash-like schemes. What’s more, the

current figures for losses against CNP transactions would suggest that

alternatives to web browser based SSL/TLS payment card e-commerce can and

should now be justifiably funded.

An ideal

requirements wish-list for online payments in e-commerce might look something

like the following:

1. Confidentiality – The payment scheme should offer

optional levels of confidentiality – allowing details of the transaction to

only be made known to those parties to whom the customer or merchant so wishes.

2. Integrity – The scheme should maintain the

integrity of the transaction – making tampering or changes to the details of

the transaction practically infeasible.

3. Authentication – The scheme should provide methods

for the authentication of communicating parties and/or the authentication of

messages that are relied upon for payment authorisation – making fraudulent

activity difficult.

4. Non-Repudiation – The scheme should provide non-repudiation

services – protecting both the merchant and customer against false claims.

5. Availability – The scheme should be highly

available – allowing customers and merchants to participate in payment

transactions when required.

6. Implementation – The scheme should provide clear

benefits to merchants and customers justifying any costs associated with the

scheme’s implementation. The implementation details should attempt to abstract

complexity and provide interfaces with merchant systems that represent good

practises in software development in general.

7. Interoperability – The scheme should be

interoperable – providing the widest possible access to merchants and

customers.

8. Ease of Use – The scheme should be easy to

understand and use for the customer.

9. Scheme Protection – The scheme rules and policies

should continue to provide consumer protection from unscrupulous or fraudulent

merchants. The scheme rules, policies and regulations should also continue to

protect the payer when a claim of fraudulent activity is made. The onus should be on the scheme owners to

disprove the validity of the claim, and not rely solely on the mechanisms of

the scheme to automatically dispute such claims.

With our

requirements ‘wish-list’ in hand, and our list of advantages and disadvantages

of e-commerce via a web browser and SSL/TLS above, let’s see how the two compare.

Web

Browser and SSL/TLS Score Card |

Requirement |

Result |

Comments |

Confidentiality |

Poor |

Apart from the secure channel between the web

browser and the web server via the use of SSL/TLS, there are no message-level

assurances (encryption or digital signatures) for card and order details.

Both the complete payment card and order details will be available to the

merchant. |

Integrity |

Poor |

As in ‘Confidentiality’ above, the lack of message-level

assurances (encryption, digests or signatures) means that the integrity of a

payment transaction cannot be assured. |

Authentication |

Poor |

Only the merchant website is authenticated via a

server certificate that is bound to the domain name of the merchant website.

Modern web browsers assist users in determining the validity of a web server

certificate. However, user awareness and education are also required in order

to ensure that the customer is visiting the intended site with a valid

certificate. The authentication of payment instructions performed by CVV2

verification, and optionally AVS where available – are considered weak forms

of cardholder authentication. |

Non–Repudiation |

Poor |

The lack of message-level signatures means that

assurances for non-repudiation are not provided. |

Availability |

Good |

Modern browsers, including mobile variants and web

servers, are able to negotiate SSL/TLS sessions. There are no intermediate

services or entities involved and so, the availability of the system is ‘as

good as’ well established web server technology and SSL/TLS implementations. |

Implementation |

Good |

All modern browsers include SSL/TLS. The process of

applying for and installing server-based SSL/TLS certificates is

straightforward and relatively inexpensive. Since SSL/TLS is a transport layer

protocol it can be implemented with minimum application level changes. |

Interoperability |

Good |

SSL/TLS is an Internet Engineering Task Force (IETF)

standard, and nearly all modern browser and web servers are able to

successfully negotiate SSL/TLS connections. |

Ease of Use |

Good |

Apart from a web browser, no additional software is

required by the user. The SSL/TLS session can be established by the server by

redirecting the client to a secure page. |

Scheme Protection |

Good |

Scheme protection against fraud on behalf of the

cardholder in the form of chargebacks has meant that – despite weaknesses in

confidentiality, integrity, authentication, and non-repudiation – consumers

have generally been willing to use their payment cards online. |

It’s

interesting to note that the ‘good’ characteristics of availability,

implementation, ease of use and scheme protection appear to have outweighed the

‘poor’ characteristics for confidentiality, integrity, authentication, and non–repudiation

in the adoption of web browser based e-commerce via SSL/TLS.

We’ll now

briefly examine a scheme that attempted to satisfy each of the major

requirements in our e-commerce checklist above, in an effort to remedy the

major security deficiencies of using payment cards via a web browser and

SSL/TLS.

2.8 SET – A First Attempt at Securing E-commerce

In 1996,

the Secure Electronic Transaction (SET) protocol was announced by Visa and MasterCard.

The aim of the protocol was to establish an open, multi-party scheme for secure

payment card transactions over the Internet.

On December

19th, 1997, MasterCard and Visa formed Secure Electronic Transaction LLC (aka

SETCo) to manage and oversee the SET specification

[58] .

On May 31st,

1997

[58] with assistance and input from GTE, IBM, Microsoft, Netscape, RSA, SAIC, Terisa

and VeriSign – version 1 of the SET protocol was published in three separate

books :

· Book 1: Business Description

· Book 2: Programmer’s Guide

· Book 3: Formal Protocol Definition

Book 1

describes the detailed objectives of SET as:

1. Provide confidentiality of payment

information and enable confidentiality of order information that is transmitted

along with the payment information.

2. Ensure the integrity of all

transmitted data.

3. Provide authentication that a

cardholder is a legitimate user of a branded payment card account.

4. Provide authentication that a

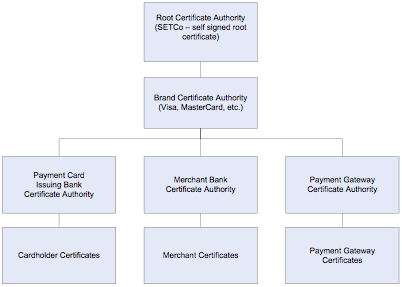

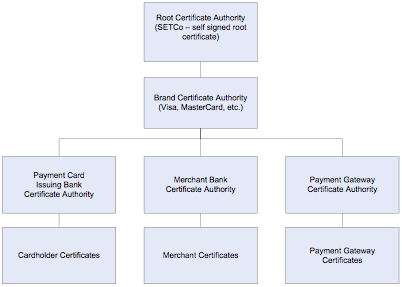

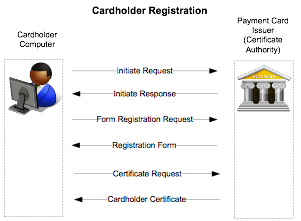

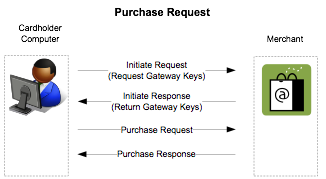

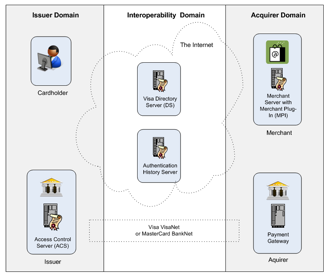

merchant can accept branded payment card transactions through its relationship